Stay Informed

Follow us on social media accounts to stay up to date with REHVA actualities

Yannick Lu-Cotrelle(manager of Eurovent Market Intelligence) is delighted with this expansion, because most of the launches of new programmes come from the manufacturers themselves: “Companies are continuously seeking information about their markets, and when they can’t find any source of reliable data, they turn to us and our know-how. We define the project with them, and then we immediately get to work on the programme as a whole: prospection among potential participants, management of statistics collections, organization of working meetings bringing EMI together with the manufacturers, and internal dissemination of the results. Of course, the entire process is performed in stringent compliance with European rules governing competition and in the strictest confidentiality of the data provided.” | * The seven main programmes of Eurovent Market Intelligence (EMI):· Fan coil units · Liquid chilling packages · Air processing units · Rooftop units · Heat exchangers · Air filters · Cooling towers |

The year 2011, which was a soft year in the EMEA area for most markets, nonetheless confirmed the exceptional dynamism of the air processing unit market. It also highlighted the two poles of recession and growth that have marked the economy, with the collapse of the Greek and Spanish markets on the one hand, and the emergence, on the other hand, of two new “European dragons”: Russia and Turkey.

The air handling unit market is the market that has revealed itself to be the most dynamic in Europe, with 1.4 billion euros in turnover, 2010–2011 growth between 10% and 12% and projected 2012 growth exceeding 5%.

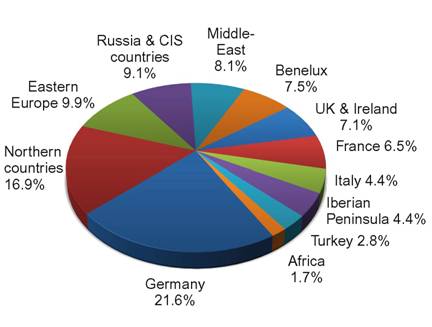

The main strongholds of this market remain in northern Europe: Germany accounts for nearly one quarter of the European market, Scandinavia one fifth, and England, the Benelux countries and Russia each have an 8% share. While the French market share stands at around 7%, southern European countries (Portugal, Italy, Greece and Spain) together account for little more than 10% of the market. The Middle East occupies a relatively minor slot in this market: its 2011 sales were barely 10% of the EMEA market; this market is dominated primarily by rooftop units that do not necessarily require the installation of air handing units.

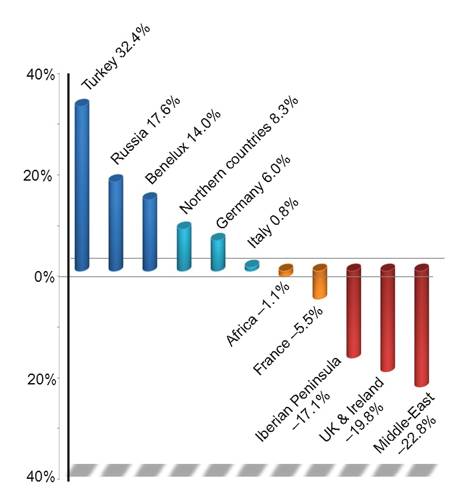

Compared with last year, the most remarkable increases were recorded in northern Europe and Russia (and their former satellite countries), with an average 20% growth. Turkey deserves a special mention: it remains the most dynamic country, with a record growth approaching 30%. The other countries with the best results are France, Switzerland and the Benelux countries, with growth around 15%, followed by Germany and Eastern Europe, whose growth is approximately 10%. By contrast, Greece, Africa and the Middle East suffered market contractions, with declines of as much as 10% in the Iberian Peninsula. No spectacular turnaround in trends is expected in 2012 in the EMEA area as a whole, except, possibly, in the Middle East, which should see a return to growth.

Half of the air handling units sold in the EMEA zone in 2010 were those with an air flow rate equal to or below 5,000 m³/h, while those operating at up to 15,000 m³/h accounted for a fifth of sales. In terms of energy class, the average falls into class B, leaning towards class A for northern Europe and Switzerland, and towards class C for southern Europe and Africa.

The fan coil unit market underwent a slight contraction in 2011 (approximately 3%) with total EMEA sales of some 1.6 million units. European sales accounted for three quarters of the market.

In Europe, Italy kept its leadership position with nearly one third of the market, while France attained a distant second place with 13%. This year, Spain was pushed out of its third-place position by Turkey, which obtained a 7% market share, with Russia hot on its heels after securing almost 6% of the market. The 6th and 7th places were taken by Germany and the United Kingdom, respectively, each with market shares of approximately 5%. The Middle East consolidated its second place slot in the EMEA market with nearly 250,000 units sold.

Compared with 2010, the northern European countries showed the greatest dynamism with an approximate average growth of 10%; the Benelux countries increased their sales by 14% and German turnover grew by 6%. Italy had a dreary year marked by the stagnation of its market, while the French market contracted by approximately 5%. The greatest declines were recorded on the Iberian Peninsula (averaging 17%), in England (which fell by 20%) and, above all, in Greece, where the market fell 50%. By contrast, the recession spared Russia and Turkey entirely, which continued their vigorous development with respective growths of 20% and 30%. For 2012, these two countries are expected to experience a strong slowdown, while the year will again be quite a difficult one for Italy. While some improvement is foreseen for Greece and Spain, no recovery from the recession is yet envisaged.

Three quarters of the fan coil units (FCU) sold in the EMEA area are, on the whole, two-pipe units with, however, a slight difference in Turkey, which is more egalitarian, and, above all, the Ireland/United Kingdom tandem, where most of the units sold are of the 4-tube type. Regarding design, two thirds of sales are split equally between encased and unencased models. One fifth of the market is absorbed by Cassette models, and 13% by encasable units.

Of some 68,000 units sold in 2011, the Middle East retained its EMEA market leadership position with nearly 50,000 units sold. Africa took second place with just under 5000 units. In Europe, the main markets remained the same, with the Iberian Peninsula holding its first place slot (18%), followed by France (17%), Italy (14%) and the United Kingdom (12%), which together account for most of the rooftop units sold in Europe.

With respect to 2011, and contrary to other markets, the rooftop unit market remained dynamic with generally creditable 2010–2011 growths and further growth projected for 2012. However, this growth primarily benefited the Middle East, with increases above 30%, while in Europe the more minor markets such as Germany and the Benelux countries profited from this trend. Elsewhere, in France, Spain, Russia, Turkey and Poland, the market was quite soft, even negative; Italy came out a little better with growth close to 10%. Conversely, the market experienced serious reverses in Greece, Africa and the United Kingdom, with sales dropping as much as, or even below, 30%.

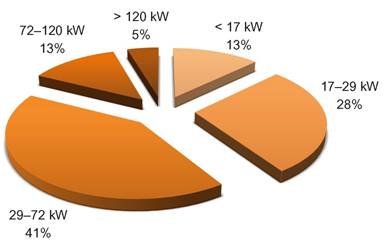

In the Middle East as in the rest of Europe, the most frequently sold rooftop units remained those with an average capacity ranging from 29 to 72 kW. However, the second market in terms of importance in the Middle East was geared mainly towards the smaller capacities below 29 kW, while in Europe that second market primarily involved large capacities above 72 kW. As regards the type of units sold, the greatest numbers were recorded, quite logically, by cooling units in the Middle East, while in Europe the reversible units (both classic and gas-powered) accounted for two thirds of sales.

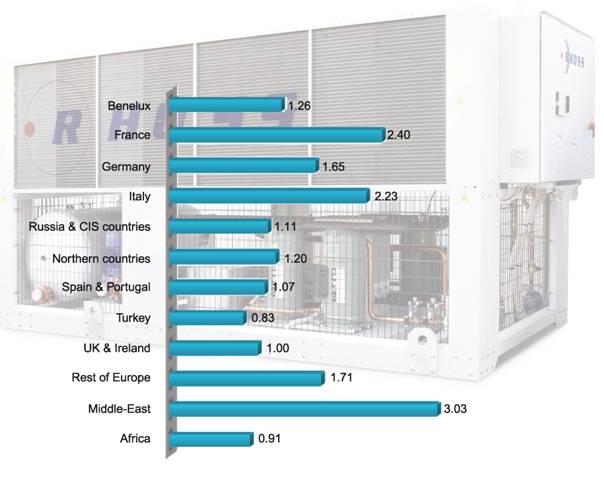

The liquid chilling package market in the EMEA zone (Europe, Middle East and Africa) attained a total volume exceeding 18 million kW in 2011, compared with 16 million in 2010. This market primarily involves the Middle East (16%), France (13%), Italy (12%) and Germany (9%).

Although sales of the smaller capacity packages (<50 kW) are traditionally concentrated in southern Europe (France, Italy, Spain), the Scandinavian and Baltic countries are also important consumers, accounting for one quarter of the European market.

In Europe, sales of medium power units (between 50 kW and 700 kW) are dominated by the trio formed by France, Italy and Germany, representing nearly half the market, followed just behind by the Benelux countries, Spain, the United Kingdom and Russia, each of which accounts for 6% to 9%. On the other hand, for high-powered units (greater than 700 kW), Turkey and Russia are on top with respective market shares of 15% and 13%, followed by the France/Germany/Italy trio, each of whose market shares ranges from 13% to 10%.

Compared to 2010, the 2011 sales of units above 50 kW stagnated in the market as a whole. This stagnation slightly affected France, Germany, the Nordic countries, the Maghreb and eastern Europe, and was more negative in the United Kingdom and Italy. The least affected countries included the Middle East, Benelux and Poland, with growth rates between 10% and 20%. As usual, Russia and Turkey managed to come out ahead with growth rates well above 20%. Conversely, significant declines were again experienced on the Iberian Peninsula (around 25%) and in Greece, where the market fell one third. Also worthy of note is Egypt, where the impact of the revolutions of 2011 strongly contracted the market and reduced it by almost two thirds, whereas it had grown by 25% between 2008 and 2011.

The forecasts for 2012 are rather mixed. They remain positive for areas which are already very dynamic such as Russia, Turkey and the Middle East, but they are clearly more lacklustre for the rest of Europe. For example, Italy, Spain and France have had quite a bad start this year, with falls ranging from 10% to 30%, respectively, which appear difficult to make up in the second quarter. Germany and the United Kingdom, which have seen more moderate market declines in the first quarter, should be able to maintain sales volumes almost equal to that of last year.

To begin with, one of Eurovent Market Intelligence’s priority lines of action entails enriching the information available in the reports. By means of working meetings twice a year, EMI strives together with the manufacturers to improve the nature of the results provided each year and to give them greater reliability and added value.

The second factor contributing to this success is making the results available on an extranet. Extranet users log on with specific passwords and the website offers a full range of marketing tools which enable the participating company to perform tailored data extractions according to their requirements. In addition to the market results, website users can follow sales fluctuations, their market share and position with respect to their competitors and the market concentration ratio, in a real-time panel display.

Finally, manufacturers are showing a renewed interest in market information. Indeed, the programmes are open to all manufacturers who wish to participate and, in a highly volatile market context, many of them want to increase their visibility in the short and medium-term and establish strategies to obtain the greatest benefit from market opportunities.

Follow us on social media accounts to stay up to date with REHVA actualities

0