Stay Informed

Follow us on social media accounts to stay up to date with REHVA actualities

|

|

|

Ivo Martinac | Stefan Plesser | Cormac Ryan |

Professor & Chair, Building Services and Energy Systems; KTH Royal Institute of Technology, Stockholm, Sweden & VP REHVAim@kth.se | Dr-Ing; CEO, synavision GmBH, Bielefeld, Germanyplesser@synavision.net | General Manager, COPILOT Building Commissioning Certification, Paris, Francec.ryan@copilot-building.com |

|

|

|

|

|

|

Han-Suck Song | Ole Teisen | Jin Wen, Professor |

Associate Professor, Division of Real Estate Economics and Finance, KTH Royal Institute of Technology, Stockholm, Swedenhan-suck.song@abe.kth.se | Chief Consultant, Sweco Denmark, Copenhagen, Denmarkole.teisen@sweco.dk | Civil, Architectural and Environmental Engineering, Drexel University, Philadelphia, PA, USAjinwen@drexel.edu |

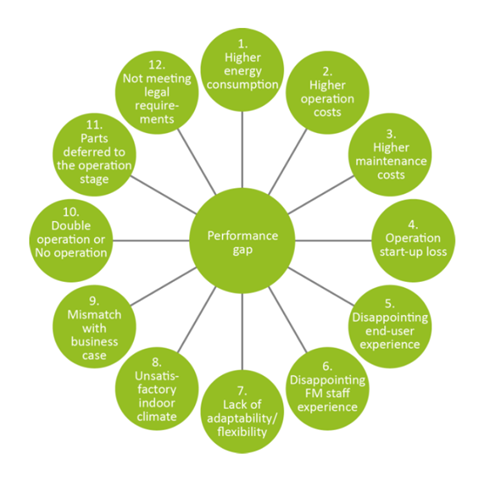

Non-compliance with predicted, contracted or otherwise required aspects and levels of building performance can result in a wide range of problems, including excessive energy use, excessive emissions of carbon and other green-house-gases, increased maintenance and operational costs, operation start-up loss, sub-par quality of building functions and services, unsatisfactory indoor environmental quality, component and system faults, difficulties in achieving targeted building certification levels, disappointing end-user experience, mismatch with business case, lack of adaptability and flexibility, expenses changed from capital expenditure (CAPEX) to operational expenditure (OPEX), facility not meeting regulatory requirements, as well as increased risk and liability. This is often referred to as “The Performance Gap, see Figure 1, (Rasmussen and Jensen, 2020).

Figure 1. A facilities manager’s typology of performance gaps in new buildings (Rasmussen and Jensen, 2020).

Recent studies indicate that only about 25% of new Swedish multifamily buildings (including those designed for high-energy-performance) comply with predicted energy use (Martinac, 2017; Kempe, 2020). Similar examples of non-compliance with predicted performance have been extensively documented by previous research (Månsson et al., 1997; Fisch et al., 2007; Fraunhofer ISE, 2011; Baumann, 2005; Plesser et al., 2012; Franzke and Schiller, 2011; Crowe et al., 2020; Coyner and Kramer, 2017; Wen et al., 2019).

Compliance with ambitious levels of resource efficiency, energy performance, decarbonisation and circularity goals, as well as other key objectives defined by the EU Taxonomy for sustainable activities (European Commission, 2021) will be essential criteria for the sustained future success of businesses throughout the building sector.

The EU Taxonomy is a classification system, establishing a list of environmentally sustainable economic activities. The EU taxonomy is an important enabler to scale up sustainable investment and to implement the European Green Deal. Notably, by providing appropriate definitions to companies, investors and policymakers on which economic activities can be considered environmentally sustainable, it is expected to create security for investors, protect private investors from greenwashing, help companies to plan the transition, mitigate market fragmentation and eventually help shift investments where they are most needed (European Commission, 2021). |

Different industries have dealt with non-performance and non-compliance issues through quality management. In engineering, “quality” relates to the degree to which a set of inherent characteristics of an object comply with requirements. Building owners should get what they pay for.

“Quality management” is thus a process of supporting the fulfilment of specified requirements. In the building sector, Technical Monitoring and Commissioning have evolved as reliable quality management services for buildings and are becoming increasingly popular. Technical Monitoring (TMon) applies procedures to compare measured values from building operation versus design target values providing a transparent result to the owner. TMon can predominantly be carried out digitally. Commissioning (Cx) allows the owner to check in detail whether the building delivered complies with the Owners’ Project Requirements. Cx requires to a significant extent skilled expert work. Since quality management starts with the definition of requirements, it obviously should start in the earliest stages of any project. Although quality management can be applied even after a building is completed, building owners should not wait until they incur the problems and costs of a failing project. Both TMon and Cx are most powerful and cost effective when initiated in the very beginning of a project. (REHVA (1), 2019 and REHVA (2), 2019).

Investments in building performance, including energy efficiency, can generate substantial economic and environmental benefits, while also increasing financial returns. The main goal of the EU-funded QUEST project (European Commission, 2019) is to promote private investments and financing in sustainability and energy-efficiency projects. To do so, it has developed a simple toolkit that will enable financial institutions to determine relevant factors that influence risk in the design, construction and operations of energy-efficiency and sustainability projects. This will allow them to reduce risk and significantly increase investment. The QUEST Consortium consisting of financial stakeholders, academic, engineering and certification experts was created to solve this problem. The consortium uses independent research and empirical data to create statistical algorithms that predict risk impact on asset value. Building on the Quest Model, it packages these algorithms into a QUEST Tool to predict value-add of different certified quality management services for specific construction and real estate investment projects. To introduce the QUEST method to building owners, the QUEST team offers Environmental, Social and Government (ESG) Due Diligence to assess the buildings in a portfolio based on selected parameters, creating a larger base for data-gathering. Building owners can learn about the implications of the EU Taxonomy for their portfolios, about investments needed to manage the improvement of the quality of the buildings and the value-add of quality management services. QUEST uses building data for continuous improvement of the QUEST Tool and data base. Interested building owners please contact us at plesser@synavision.net. |

An increase in the financial profitability of real estate investments is a key financial motivation for implementing the QUEST model. Due to the large size of the real estate assets, and the many important economic and sustainable finance linkages between the real estate markets, the debt and financial markets, and the wider society, the importance of accurate assessments of the linkage between buildings’ technical and financial performance are key for increasing the flow of funds and other resources necessary for the sustainable development of real estate and financial markets.

Lower technical risk should be transmitted to improved financial performance of real estate investments. Therefore, buildings that have successfully implemented building quality management activities that de-risk a building’s technical performance should also be reflected in a decline of financial risks and consequently result in improved financial performance.

However, currently the investment community has difficulty quantitatively (statistically) evaluating technical risk on specific construction and real estate investments and the impact of innovative quality management services on real estate financial performance. An analysis of real estate financial performance must consider how technical risk impacts on the profitability by increasing revenues, lowering costs, and by lowering the risks and uncertainties regarding the size of future revenues and costs.

The QUEST model contributes with transparency in relation to what it costs to handle the technical risks through quality management on the individual construction project and on the return on investment of this investment.

Within the context of the QUEST Project, the QUEST Tool was created to evaluate the quantitative impact of certified quality management services on value-add of real estate financial performance. While a particular situation may have an innate level of technical risk, that risk can be reduced by application of standardized and verifiable processes. In order to achieve internationally replicable, scalable and trusted technical risk modulation via Quality Management, QUEST relies on Certified Quality Management Services. These are international third-party building certification processes (conforming with eg EN ISO 17065) that can impact building Capital and/or Revenue:

·

Certified Technical Monitoring

that verifies correct functioning and

operation of installed technical systems

o Example: COPILOT Digital Technical Monitoring Certification (Copilot, 2021)

·

Certified Building Commissioning

that verifies compliance with Client Project

Requirements through planning, design, construction/renovation &

installation, and initial operation of a new or existing building.

o Example: COPILOT Building Commissioning Certification

·

Certified Sustainable (or Green)

Building

mainly a desk-top exercise that verifies compliance with environmental and

related standardswith some

form of Commissioning process involved to ensure that the good intentions also

become a reality.

o Example: BREEAM2 (BRE Global Ltd)

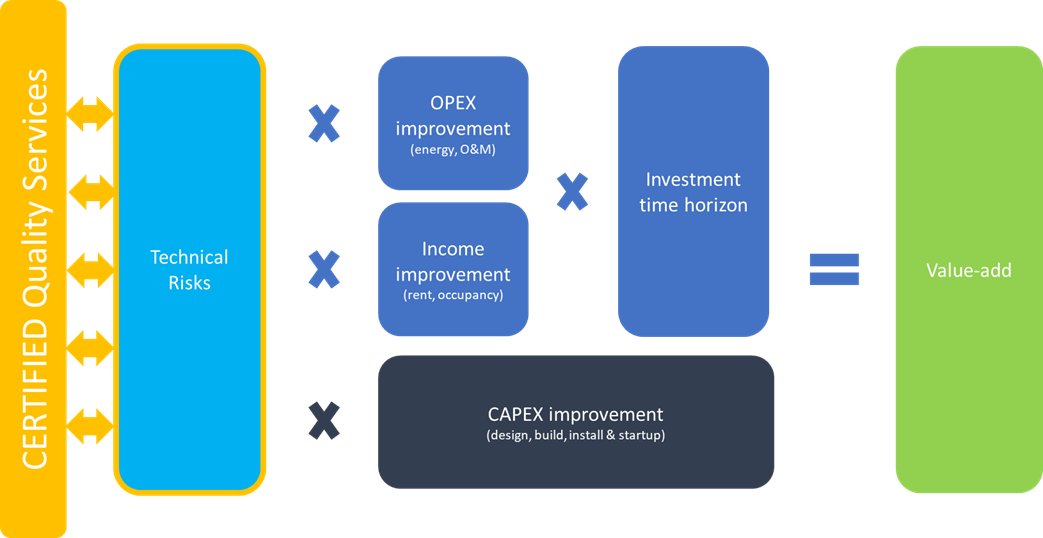

The QUEST-Tool applies an algorithm to technical and financial data of investments into these Certified Quality Management Services. Investors can risk-grade investments and select the most profitable quality management services to de-risk projects. Figure 2 shows a schematic illustration of the algorithm. A main feature and important contribution of the QUEST Tool is to integrate detailed information about how different levels of technical risk, which typically is excluded from real estate financial analysis calculations. Even when technical risk is considered, it is often limited to aggregated and standard figures, and thus do not reflect the true technical risks and how they should be translated into the financial performance or real estate investments.

As shown in Figure 2, investments in certified quality management services result in positive value-add effects through lowering technical risks, which in turn result in lower and more stable annual operating expenses (in the figure denoted OPEX Improvement), higher and more stable annual revenues (in the figure denoted Income Improvement) and finally lower and more stable construction and renovation costs (in the figure denoted CAPEX Improvement). The investment time horizon is time factor in year units that is multiplied with the OPEX and Income effects. This time factor takes into account the fact that an initial certified quality service investment might have effects on revenues and costs for several years ahead.

Figure 2. Schematic illustration of the algorithm(s) applied to technical and financial data of investments into Certified Quality Management Services.

A key innovation of the QUEST methodology is to include numerical figures of technical risk indicators. Initially the risk inputs relied on self-assessment of different technical risks in a building or building project:

· Technical risk impact on energy consumption and costs

· Technical risk impact on operation & maintenance work and costs

· Technical risk impact rental income

· Technical risk impact on occupancy rate

In order to reduce variability of this self-assessment, QUEST has decided to propose technical risk profiles which depend on user feedback regarding:

· Building type (ex. laboratory deemed higher risk profile than residential property)

· User confidence/experience in the technical teams managing the project

QUEST is designing a solution for financial stakeholders who do not have the expertise to directly assess building technical risk. However, they can evaluate their risk perception of technical management teams based on their experience and/or confidence in these teams. Work together on, and results from, past projects can contribute to this assessment.

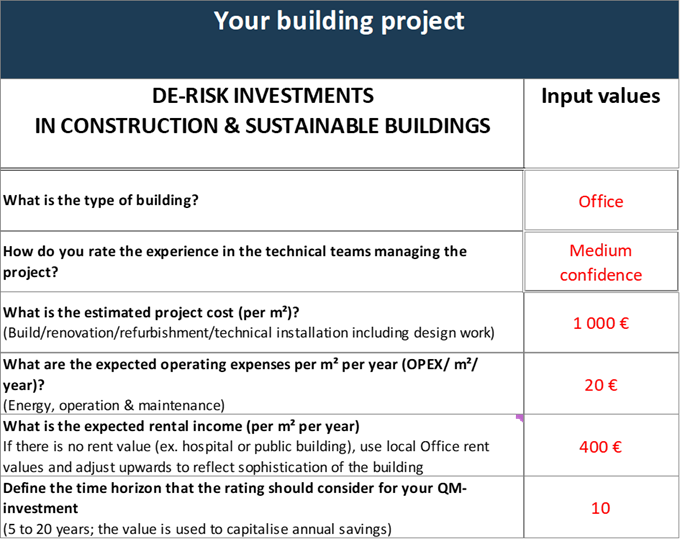

The QUEST Tool users input six project characteristics:

· Building type | } | è | Technical risk surrogates | |

· Experience/confidence in the technical teams | ||||

· Project build cost è Capital saving calculation |

| |||

· Building systems operating cost è Cost improvement calculation |

| |||

· Rental income è Income improvement calculation integrating rent and occupancy impacts |

| |||

· Time horizon of investment è Capital saving calculation |

| |||

The Tool proposes default values for each element in case the user fails to enter their values.

Figure 3. Inputs to QUEST Tool.

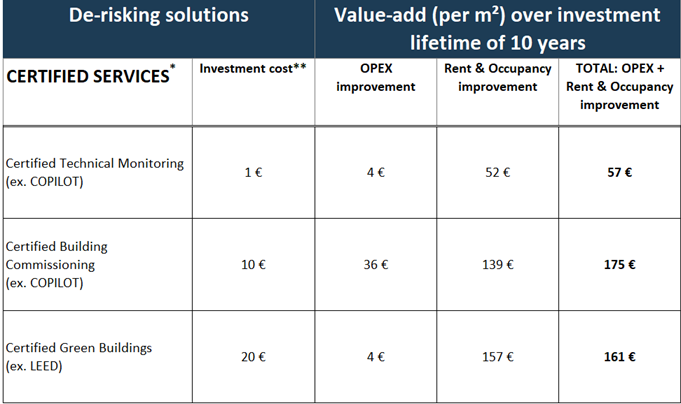

Based on these elements, the Tool predicts value-add of different Certified Quality Services. The following value-add forecasts are available:

1. Value-add prediction based on OPEX improvement from energy and operation & maintenance savings;

2. Value-add prediction based on rental income and occupancy rate improvements from better buildings;

3. Value-add prediction based on all cost and revenue improvements in 1 and 2 above.

The Tool also provides indicative investment costs for Certified Quality Services including expert audit costs and certification fees.

* Certified quality services provided by independent third parties to approved certification rules

** indicative costs (verification by accredited expert + certification fees) based on Building > 2000 m² with significant project cost (costs/m²)

Figure 4. Outputs from Quest Tool.

To empirically establish the causal effect of QUEST model and quality management on real estate market valuations, hedonic panel data analysis based on the real-world observations from the real estate market will be developed. The main goal is to estimate the causal effect of the level of Quality management services on value-add of real estate financial performance. The variation in the financial performance between real estate assets is determined by several characteristics, such as building characteristics, quality management characteristics, neighborhood characteristics, and locational characteristics. In addition, many urban, regional and macroeconomic variables also influence real estate financial performance. The QUEST Consortium therefore has started the development of a real estate panel data set will consisting of repeated observations on the same properties over time. For projects with and without Certified Quality Management Services, property characteristics information (including quality management service level and sustainability characteristics), and estimated financial and technical risk performances are collected annually.

This article is prepared within the scope of the QUEST project, which has received funding from the European Union’s Horizon 2020 research and innovation programme under the Grant Agreement number 846739. The European Union is not liable for any use that may be made of the information contained in this document, which is merely representing the authors’ views.

QUEST – Quality Management Investments for Energy Efficiency.

REHVA website: https://www.rehva.eu/eu-projects/project/quest

· Baumann O. (2005): OASE – Optimierung der Automationsfunktionen betriebstechnischer Anlagen mit Hilfe der dynamischen Simulation als Energie-Management-System. Abschlussbericht zum Vorhaben OASE, Förderkennzeichen 0327246D. München.

· Copilot (2021): https://copilot-building.com/, as accessed 21/5/2021.

· Coyner R., Kramer S. (2017): Long Term Benefits of Building Commissioning: Should Owners Pay the Price?, Creative Construction Conference, Primosten, Croatia.

· Crowe E. et al (2020): Building Commissioning Costs and Savings Across Three Decades and 1,500 North American Buildings. LBNL, Energy Technologies Area.

· European Commission (2021): EU Taxonomy for Sustainable Activities. https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en, as accessed 21/5/2021.

· European Commission (2019): Quality Management Investments for Energy Efficiency (QUEST). Horizon 2020 Grant Agreement ID 846739, https://cordis.europa.eu/project/id/846739, as accessed 21/5/2021.

· Federation of European Heating Ventilation and Air Conditioning Associations (REHVA (1), 2019): HVAC Commissioning Process. Guidebook No. 27, Brussels.

· Federation of European Heating Ventilation and Air Conditioning Associations (REHVA (2), 2019): Quality Management for Buildings. Guidebook No. 29, Brussels.

· Fisch M. N. et al. (2007): EVA - Evaluierung von Energiekonzepten für Bürogebäude: (Gesamt-) Abschlussbericht. Braunschweig / Hannover, Technische Informationsbibliothek u. Universitäts-bibliothek.

· Franzke U. and Schiller H. (2011): Untersuchungen zum energieeinsparpotenzial der Raumlufttechnik in Deutschland. ILK Dresden, Fachbericht ILK-B-31-11-3667, Dresden.

· Fraunhofer ISE (2011), ModBen – Endbericht: Modellbasierte Methoden für die Fehlererkennung und Optimierung im Gebäudebetrieb. Freiburg.

· Fuerst, F. (2008): Office Rent Determinants: A Hedonic Panel Analysis. SSRN Working Paper Series, DOI:10.2139/ssrn.1022828.

· Kempe P. (2020): Förstudie: Stegvis verifiering av delsystem - Exempel VVC-system. Lågan Rapport.

· Martinac I. et al. (2017): Brukaranpassad, hållbar byggnadsdrift med fokus på inneklimat och energiprestanda i kontorsbyggnader – en kunskapssyntes (User-adapted, sustainable building performance management with focus on indoor environment end energy performance in office buildings – a knowledge synthesis. In Swedish). Final Report, Energimyndigheten (Pnr 42639-) & SBUF (Pnr 13293). Stockholm.

· Månsson L-G et al (1997): IEA Annex 17: Building Energy Management Systems – Evaluation and Emulation Techniques.

· Plesser S., Gräff S., Rozynski M. and Fisch M. N. (2012): www.EnBop.info - Netzwerk für Betriebsoptimierung. Intelligente Architektur XIA 04-06 2012, Seite 066-071, Leinfelden-Echterdingen. 2012.

· Rasmussen H.L. and Jensen P.A. (2020), "A facilities manager’s typology of performance gaps in new buildings", Journal of Facilities Management, Vol. 18 No. 1, pp. 71-87. https://doi.org/10.1108/JFM-06-2019-0024.

· Wen J., Chen Y., Regnier A. (2020) Building Fault Detection and Diagnostics. In: Baillieul J., Samad T. (eds) Encyclopedia of Systems and Control. Springer, London. https://doi.org/10.1007/978-1-4471-5102-9_100080-1.

Follow us on social media accounts to stay up to date with REHVA actualities

0